When struggling Traders find out that I now Trade consistently profitably they always want to know the secret, the “Holy Grail” but go blank when I start talking about routine. Its like I’ve sent them to sleep. As previously discussed, I found my holy grail at home in the bathroom. Staring back at me in the mirror. But what that actually means is that by changing me, my psychology, my mindset. I went from an erratic inconsistent, in out Trader to a calm disciplined consistent Trader. How? …

I Created a Routine

Routines are how we create habits and habits are tremendously formidable. Habits are how our subconscious functions, it uses habits to run more efficiently. A good routine creates good habits, a great routine creates great habits. However, a bad routine creates bad habits. All successful people have successful routines that have created successful habits.

I don’t know if you have heard the term “Successful Trading is a Marathon not a Sprint.” Not only is it true it’s also very apt. Because successful marathon runners have very powerful routines that allow them to see advances day after day. So that they can eventually run the full marathon, their intense routine keeps them pushing their limits and improving their endurance so that they can make it to the finish line.

Thus as Traders we need to do the same. Our Trading journey is started knowing very little to nothing about the markets. We then gain some education, write a Trading Plan. Create a Trading Journal and read some books and day by day our ability to trade gets better and better. So that we learn how to read the charts, spot the patterns and get a feel for market behavior.

At this point many traders decide that trading is not for them for many reasons. Some find other passions or life throws them onto a different path, but a few stick with it. They continue to take one step forward every day in that long journey to consistent profits in the market.

Both marathon runners and traders make it because of their routines. It takes stamina, there are no alternatives, no shortcuts. Forget the get-rich-quick attitude, there is no such thing, it’s a myth. It takes hard work and dedication. A marathon can’t be finished without training. Similarly, consistent and profitable trading doesn’t happen without continuous improvement. That’s where trading routines come in.

Pareto Principle (80/20 Rule)

The Pareto principle states that, for many events, roughly 80% of the effects come from 20% of the causes. Essentially, Pareto showed that approximately 80% of the  land in Italy was owned by 20% of the population; Pareto developed the principle by observing that about 20% of the peapods in his garden contained 80% of the peas. It is a common principle in business management; e.g., “80% of sales come from 20% of clients.” “80% of complaints come from 20% of your customers”.

land in Italy was owned by 20% of the population; Pareto developed the principle by observing that about 20% of the peapods in his garden contained 80% of the peas. It is a common principle in business management; e.g., “80% of sales come from 20% of clients.” “80% of complaints come from 20% of your customers”.

In trading this same principle applies 80% of your results will come from 20% of your actions. What you must learn to understand is that the 20% is not what you think it is, or you wouldn’t be here. The 20% is probably what you think is not very important, but will actually make the real difference to your trading.

1. Weekend Analysis and Review

For me, my week starts on Sunday. I spend about 30 mins reviewing my weeks activities with the help of my trading journal. What did I do well? And What can I improve upon? I am basically going over my end of day reviews quickly to make sure I didn’t miss anything. nd that I didn’t make any mistakes.

Are there patterns or repeats of mistakes, or is there a pattern and repeat of the things I did well. Some Sunday’s my review period may be longer as I do Monthly and quarterly reviews on Sunday also. These consist of checking that I am moving forward towards my goals. Am I on track? Do I need to change course slightly or majorly? Is my trading plan still working? Where am I in my Strategy Research? These are all the questions I cover in my month and quarterly reviews.

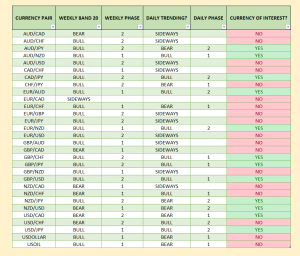

Once I have established my trading plan is still working and that I am avoiding making any costly mistakes. I move onto Market Analysis this will be different for everyone and will depend entirely upon your rules. My analysis rules are part of my trading plan. I am looking for currency pairs of Interest for the week ahead. I do not want to be trawling through all the currency pairs looking for setups all week.

Sunday

This is my Sunday afternoon routine. Which has become my habit. It is no longer a chore, because I know exactly what I am doing, I don’t waste time when I am doing it and it is saving me time during the week. So, I enjoy it. I find my currencies of interest I write my analysis on the chart. Based on “If the market does this I will do that”. If the market doesn’t give me the setup I expected I stay out as per my rules.

This routine is probably the most important routine I have. The reviewing is essential, because even with the best will in the world. Your emotions will get pulled about all week while you are trading and sometimes the reviews at the end of the day miss something. So, they keep you in check, it is also when you spot ideas that could improve your strategy with no extra work in the process of trading itself. Obviously, you will need to test it before implementing it, but without reviewing your journal you would never have the idea…

The Analysis part should produce for you a watchlist. These are the only currency pairs you observe all week. We do this to keep us from looking at all the currency pairs all week because this is when mistakes are made and over trading is most likely to happen. We also have our instructions on the chart as to what we are looking for. This keeps us from making emotional decisions while the market is open.

Every step of the review and analysis is to prevent emotional decision making. We achieve this because the market is closed when we are doing our review and analysis. When the market opens our decisions have already been made. This is very important if you want to be a successful Elite Trader. It’s our positive and negative emotions that prevent us from being successful in the market. So, our first job as traders is to limit our exposure to those emotions.

2. Trading Journal

This is an obvious must. If we don’t have a routine where by we complete our trading journal either as the trade is placed or at the end of the day. We will have nothing to review. Ideally our journal should include as much information as possible including your present emotions and gut feelings. The more information the better, as this will lead to more productive reviews. My next blog will go into much more detail of the Trading Journal. Giving you tips and tricks to getting as much information into one place quickly and effortlessly. While keeping it simple to review at the weekend.

When Journaling I tend to focus on the R multiples (courtesy of Dr Van Tharp, “Trade your way to financial freedom”). I do this for one simple reason, money is an incentive but not a motivator for us, as human beings. Which basically means it is emotionally charged, this acts against us. That’s why it doesn’t motivate us. Money is never the motivator. But using a line graph of our $ R is a good motivator.

I personally use $ R over pip R as the $ R is more accurate as I include the swaps and commissions. I would suggest you do the same.

3. Daily Trading Tasks

These are the nine tasks I do daily before during and after trading. This is my routine, which has become my habit. It is an essential part of me being a successful Elite Trader. And by successful, I mean that I am consistently profitable every quarter. Calm and completely disciplined when trading. All so that I can maintain a high standard of trading at 90% mistake free which I am constantly aiming to improve. This, I achieve by doing my trading tasks every trading day. Below are my nine steps with a very basic description. I will probably break each one down to its own Blog as there is too much information to cover here. But this will give you an idea of my processes.

1. Self-Examination; Am I fit to trade today.

2. Visualizations; I practice in my mind. Seeing my signal and taking the trade.

3. Focus and Intention; I remind the universe of what I am trying to achieve today and ask for its help in accomplishing it.

4. Tracking Phase; Now I turn on my charts and track my currencies of interest.

5. Activity Phase 1; I see my signal and I take the trade.

6. Observation phase; Either Precise or Birds eye view.

7. Activity Phase 2; I see my signal and close the trade.

8. The debrief; Complete the journal if not already done. And ask if there were any mistakes.

9. Gratitude; Be thankful for what went well.

The Big Picture

Trading is a tug of war between your logical mind and your “fight or flight” emotional subconscious mind. The subconscious mind is a super computer that likes finding ways to work quickly and efficiently. These are habits, the subconscious loves habits. So, as we traders we need to install new empowered Trading Habits, to help give us a better Trading Mindset. We do this through routines and repetition. The routines above will only work if you have taken the previous steps.

Got to have your Big SMART Goal, your destination. Where do you want to be in 10 or 20yrs. This when reverse engineered will give you more SMART Goals these are your life goals health, wealth, family etc… Your wealth goal is the destination for your Business plan. The business plan is the map. Within this business plan will be your trading plan.

For the above routines to work you must have a detailed written trading plan. This is how you will win this tug of war. By following your trading plan to the letter passionately, using the above routines to leverage your advantage. These routines in turn will stop you flipping through time frames and markets, hunting signals. They will stop you following your trades tick by tick. The confidence in your trading plan will stop you going through forums hoping to find a better trading method.

How this helps

All of this will stop you micro-managing your trades and being glued to the screen. You will no longer have an urge to look on the lower time frames once in your trade, nor will you seek confirmation from your peers. It will also stop the need for you to argue with other traders on social media.

Routines combined with Trading Plan and Trading Journal equals the righteous path to successful trading. This is achievable because you now make all your trading decisions before you enter the market, your emotions can not hijack you. You have your trading plan and you stick to it. But you must complete all the steps, as each one builds on the next. By building confidence and discipline at each level, you learn to control your emotions. And understand their purpose. Then and only then will they stop effecting your trading.

Take the steps, start the routines…

If you are struggling to learn to trade consistently by yourself, then I would suggest taking a look at our Trading Room. Here you will gain access to two coaches, Andres – Director of Trading and myself Director of Trading Psychology. Where else can you learn and be coached by a Trading coach and a Trading Psychology Coach, while making pips?

To Your Consistently Profitable Trading

Callum

P.S. What did you think of this Lesson? Please share it with us in the comments below!

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Callum McLean

Latest posts by Callum McLean (see all)

- Why everything you’ve been taught about risk is all wrong and how it’s keeping you poor! - November 28, 2018

- How Successful Traders Embrace Loss in Order To WIN! - November 24, 2018

- One Bias That Could Be Causing All Your Trading Frustrations… - November 14, 2018

[…] an Elite trader is all about routines, make these daily tasks your routine and the success will […]

[…] some semblance of structure and have boundaries. Consider planning your working hours and creating routines for the week ahead and schedule them in your diary or calendar. Also schedule in leisure time, […]