Every few weeks, someone online asks me the same exact thing. I don’t mind. But I figured I’d officially answer it here forevermore, and also let it serve as a teaching moment. In future, when I inevitably get asked the same question or a close variation, I’ll just reply with a link to this article.

I’m not shy about touting my performance. I don’t believe in false modesty, or any other kind of modesty, if we’re being honest. I long ago decided that I wasn’t put on this good Earth to be liked by everyone, but to have as much fun as I could, with the least effort involved in life maintenance activities. Did I work for a living for a good two and a half decades? Yes, I did. Did I like it? No, I did not. And throughout those two plus decades, my unswerving goal was to not have to work as early as possible. No waiting for retirement age for me, or worse, dropping dead at my desk while still waiting for my next paycheck. I actually saw the latter happen multiple time to colleagues.

Trading was my escape hatch. It replaced and exceeded my salary, more than ten years ago, and my salary was in the high 6-figures. I am also very vocal in saying that trading isn’t for everyone. In fact, it’s for the very few, not for the many. It has some pretty strict requirements, many of which aren’t under people’s control. The big killer, of course, is insufficient money to trade with. You can’t make more money appear for you to trade with by snapping your fingers. “You either got it, or you ain’t”, as they say in Brooklyn. Let me rephrase that. You can know everything I know about trading and then some. You can be 10 times better at it than I am. And you will still fail if you don’t have enough capital to trade with. Doubling your money after a year’s worth of trading is great, if you doubled $200,000, not so great, if you only doubled $500.

And there are many other pitfalls, which individually and collectively can doom an aspiring trader before they even start. I have documented these pitfalls as best I could in my Rules’ book. I strongly urge that everyone interested in trading read it before starting. It will save most of you a lot of heartache and much, much money. I’ve seen people lose not just money, but marriages, families, jobs, and even their primary residence to foreclosure, over their mistaken ideas about trading. I can save you from all that, for the price of a couple of cups of coffee, if you read my book.

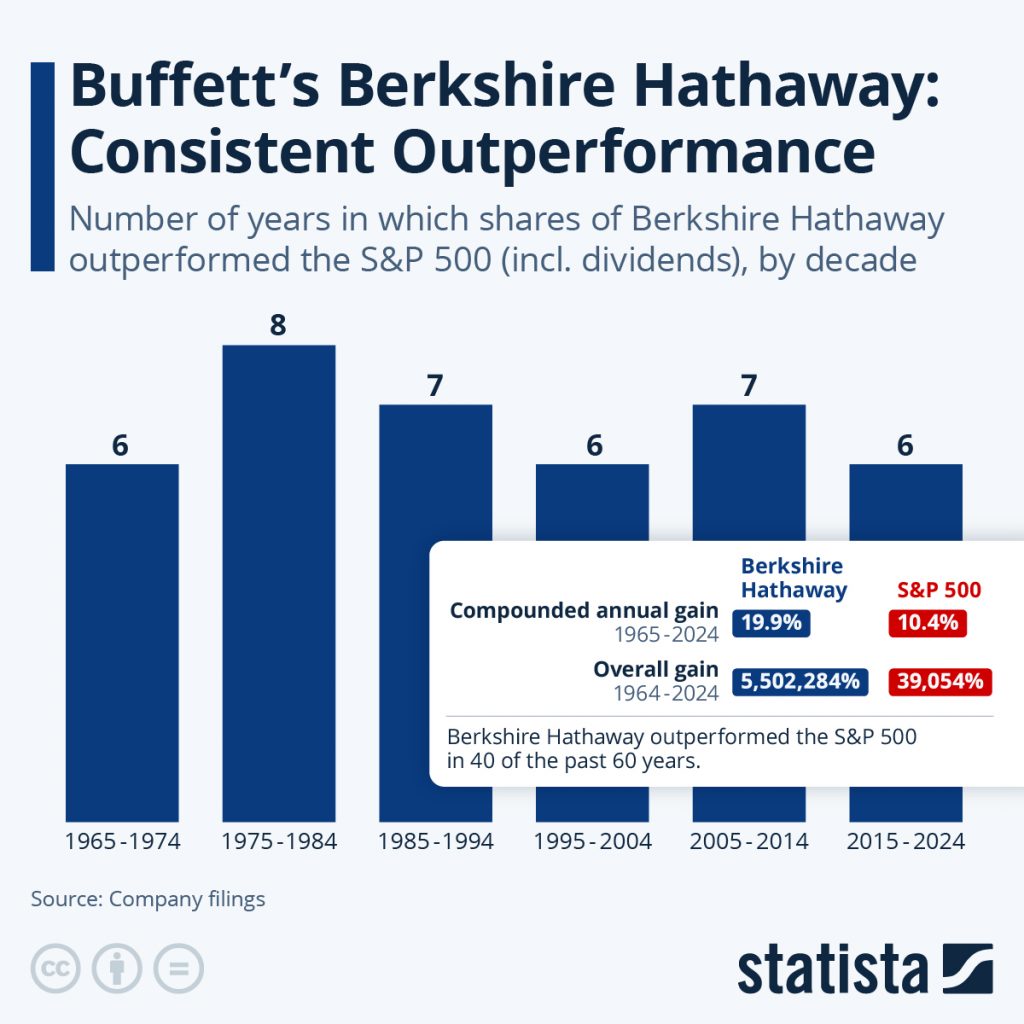

But back to our topic. I have averaged 100% returns a year for over 10 years now. That is an annualized average, which hopefully, is a term familiar to you. Yes, trading does require some grasp of math, statistics, and probability. I don’t make a 100% every year. I have never said that. Some years I make less. Some years I make more. When you crunch the numbers on my performance, my accounts behave as if I had doubled my money yearly on average, even though 1 year was all but flat, and another year was almost 300%. Looking at Warren Buffett’s Berkshire Hathaway and the S&P 500, we find these metrics.

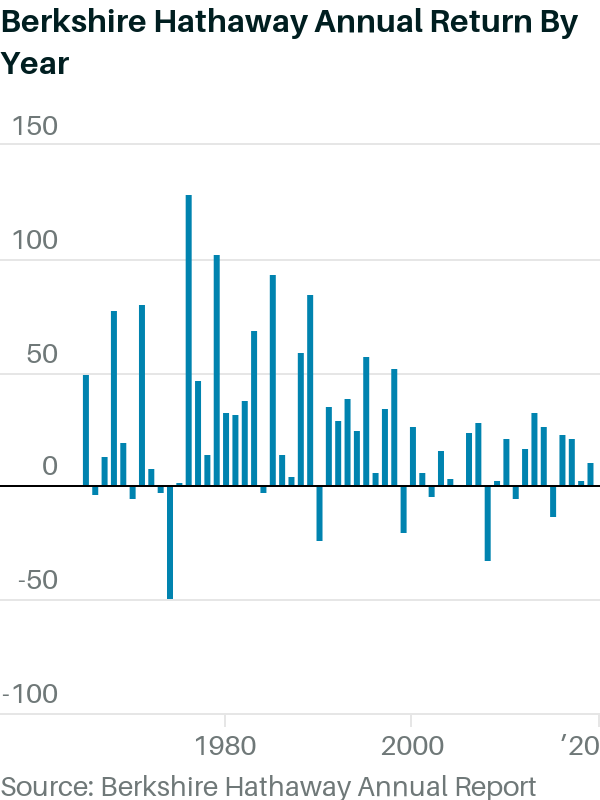

Buffett’s annualized average is almost 20%, versus the S&P’s 10%. And those gains compound. That’s really important. But looking at a detailed chart of Berkshire Hathaway, we find this.

Berkshire Hathaway has had negative years. At least 11 of them. It has also had 2 years that exceeded 100%, and 10 that exceeded 50%. When you add them all up and average them out, you get that 20% annualized average displayed on the chart. Why the negative years? Because no one can predict or control the market, not even Warren, and certainly not me.

So when I say my annualized average is 100% returns, there are a couple of things you need to know. First, I’ve only been doing it for a bit over a decade, Warren has been doing it since 1965. I am old today, and I wasn’t even born when Warren started. Pretty sure that if I last as long, my annualized average will start coming down. Why? Because eventually, I, too, will have a very bad year. Like Warren in the seventies, when he had a 50% drawdown. That’s half his balance gone, poof!

Another thing you need to know is that I operate in a different market. Warren buys shares in companies and, often, entire companies. I trade the forex market, which pits one currency against another, and you make money when you back the one getting stronger against the other. There is another key piece of information, but I’ll save that for a later paragraph in this article.

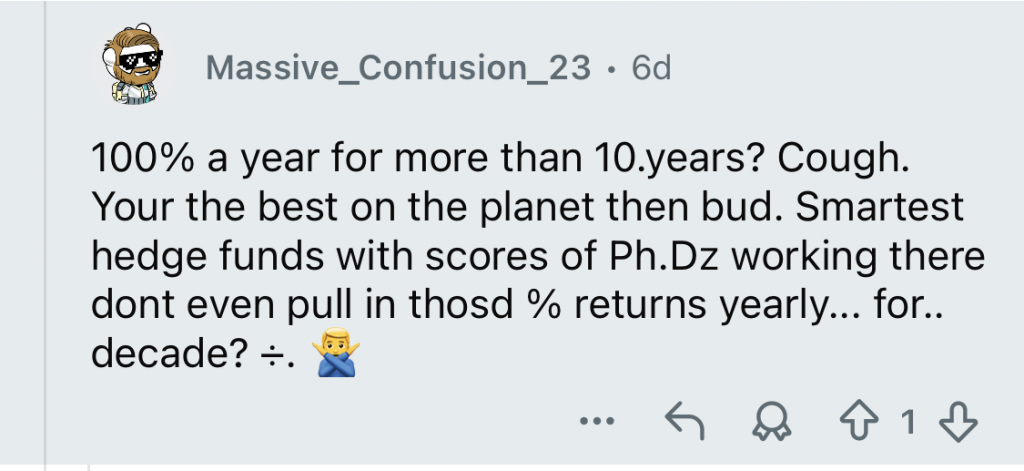

Anyway, since that 100% annualized average of mine is out there in the wild, and has been for some time, it invariably gets seen for the first time by someone who thinks they understand trading. I’m not making fun of anyone. We all started knowing nothing. Even Albert Einstein, at some point in his life, didn’t know numbers, much less physics. And trading-expert-guy’s question always goes like this.

So let me address each point.

- 100% a year for more than 10 years? No. I never actually said that. I said 100% annualized average over more than 10 years. That’s not the same thing. Though, to be honest, I’d be happy with either one.

- Your (sic) the best on the planet then bud. If I’m feeling less than charitable, I point out that they need to work on their grammar. It really tells a lot about a person, how they speak and write. But, beyond that, I never said nor implied that I’m the best. In fact, I personally know people who average three times as much as I do, with probably less effort.

- Smartest hedge funds with scores of PH.Dz (sic) working there don’t even pull in thosd (sic) % returns yearly… for… decade? I think I get what he’s trying to say. He’s wrong, though. Some hedge funds do pull in those returns, but they’re usually private or are even smaller ones managing their own money, think family offices. No public reporting. But this part of the question is actually the interesting bit. I will address it further below.

Thing is, there are a few differences between me and a hedge fund, or a publicly traded holding conglomerate like Berkshire Hathaway.

A key one is that I don’t answer to anyone. I don’t have partners. I don’t have shareholders. I don’t have the SEC demanding quarterly reports and disclosures. That means I can take whatever risks I want with my money because it is my money. No one else’s. I don’t have a quota I need to beat. No one to keep happy other than myself.

Hedge funds and other SEC-regulated institutions can’t do what I do. They can’t go all in on a great trade because their compliance rules wouldn’t allow it. They might also need to liquidate a trade at the worst possible time because it got close to breaking a compliance rule, or because a big investor decided to pull out their money, or a hundred other reasons.

Me? I only answer to myself. I have kept a losing trade alive for way longer than a hedge fund could have, because I believed in it and had no external pressure bearing down on me. And seen that trade turn around and make me 10 or more times the amount at risk. 20% of my trades bring in 80% of my profits, classic Pareto Principle.

Another one that is just as important, and very often completely ignored by trading neophytes, is the amount of capital in play. Or, like the title says, size does matter. I’m just a guy with a cockatoo trading from his living room, or from a cafe, or occasionally, the beach. I only have between $200K and $300K in trading capital at any given time. A hedge fund will have hundreds of millions all the way up to billions of dollars. Doubling my comparatively small amount is actually a trivial exercise that merely requires finding a few good trades (trends) each year and loading them up with as much capital as I can bring to bear.

Not all at once, of course, because I don’t know beforehand which trades will be big winners. But as the trades evolve, I move more and more capital into the promising ones. A technique which I call stacking (or pyramiding in), and multiply those trades’ profits accordingly, while getting out quickly from slower movers and small losers.

This is something else most institutions can’t do, because it would violate their risk and compliance rules. I can often end a year all in on a productive trade on a single currency, with most of the profit protected by an adjusted stop loss, but that’s still admittedly a huge risk. One that a larger institution can’t take. I’m fine with it. And my non-existent partners, shareholders, auditors, and regulators don’t have a say in how I operate.

This is where being small and nimble allows me to outperform the bigger and better institutions full of all those “Ph. Dz” that the guy above was so in love with. I can turn on a dime. I can liquidate all my trades in seconds and go in in the opposite direction. I can take 6 months off. It can take a month or more for a hedge fund to unwind a position. You can’t just dump billions of dollars in shares on a random afternoon. Not enough liquidity, plus you’ll tank the price.

Too little money, and by that I mean less than a few thousand dollars? You’re not going to make it. You won’t be able to take all the likely trades, close out the poor ones, and feed the good ones. Well, you won’t be able to with my approach, and I don’t know of an approach where you would survive. And even with a few thousand dollars, and assuming you do at least as well as I do, what did you do? Trade a whole year only to make a few thousand dollars?

Too much money, as in tens of millions to billions of dollars? You can definitely make it work, but probably not to the tune of 100% annualized average returns, because you will have constraints that I don’t have. Oversight. Compliance. Regulators. Partner agreements. And the like. Warren is better at this than I am, I guarantee it. So let’s assume that making 20-30%, like Warren does, is a likelier target. That’s not bad at all, since 20% of billions is way more than 100% of $300K.

Lastly, cause this also gets asked a lot, why don’t I have hundreds of millions of dollars if I’ve been compounding my money consistently for more than a decade? Because I haven’t been compounding it. I live off my profits. My trading capital has grown over the years, because I spend less than I make, but it’s still not the same as compounding, because I do take money out. I could have done the compounding thing. Stayed employed another decade and let it all compound, but I didn’t want to. I preferred to enjoy my life, and I have. It was more important to me not to work for a salary than becoming filthy rich in a couple of decades. You may have different goals, but those were mine.

And why do I teach, and write books, and write these articles? Because I enjoy it. I get joy from sharing these things, and infrequently, finding a kindred soul. But why do I charge for what I do if I don’t need the money? Because my time is worth more than money. If you want my time, you pay for it. And, to be honest, no one respects free stuff. I know. I don’t respect free stuff, either. When I’ve taught for free, I invariably get no-shows and other unprofessional behavior. Very little commitment. People who don’t pay will not respect what they’re given. Go look at public housing and compare those properties with owner-occupied ones. If it’s not costing you anything, you don’t respect it or value it. Also, if you can’t pay me, what are you going to trade with? I charge less than what you’ll need in order to trade successfully.

I hope that clarifies everything. If it doesn’t, drop a comment.

Before I close this article out, a reminder that our Candlestick Pattern Recognition Software for MetaTrader 5 is on sale right now, and through the rest of the year. Get it at this link. The code LAUNCH25 will automatically be applied for a permanent 25% discount.

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Andy Pedraza

Latest posts by Andy Pedraza (see all)

- Black Swans - January 4, 2026

- Why Size Matters - December 21, 2025

- Why Trend Following is Easier and Less Risky - December 2, 2025