The phrase “Black Swan”’s earliest documented use is in Latin, from the 2nd-century Roman poet Juvenal’s characterization in his Satire VI of something being “rara avis in terris nigroque simillima cygno” (“a bird as rare upon the earth as a black swan”). When the phrase was coined, the black swan was presumed by Romans not to exist. The English phrase “rare bird”, meaning an odd or exotic person, is derived from the same line of Juvenal, and for centuries, this was the case. There were no Black Swans.

Then, in 1697, the Dutch came to the then unexplored by Europeans territory of Western Australia. And what did they find? You guessed it! Black swans. The term subsequently metamorphosed to connote the idea that a perceived impossibility might later be disproved. And it has further metamorphosed to mean a rare and unexpected event, especially in the markets.

And that’s what I mean when I use the term. It’s the rare, unexpected event that can cause such mayhem in the markets that brokers can go bankrupt, forget about traders. Markets, of course, are unpredictable by nature, but Black Swans are an entirely higher order of unpredictable. The only thing we can know for sure is that there is always another Black Swan in our future, but we never know its exact nature or when it will come.

If you are on the wrong side of a Black Swan, you can be wiped out. If you are on the right side, you might make ten years’ worth of trading income in a day, or you might also be wiped out. Why the latter, if you were on the right side of it? Because your broker might have been wiped out, along with your illusory winnings and any equity on deposit.

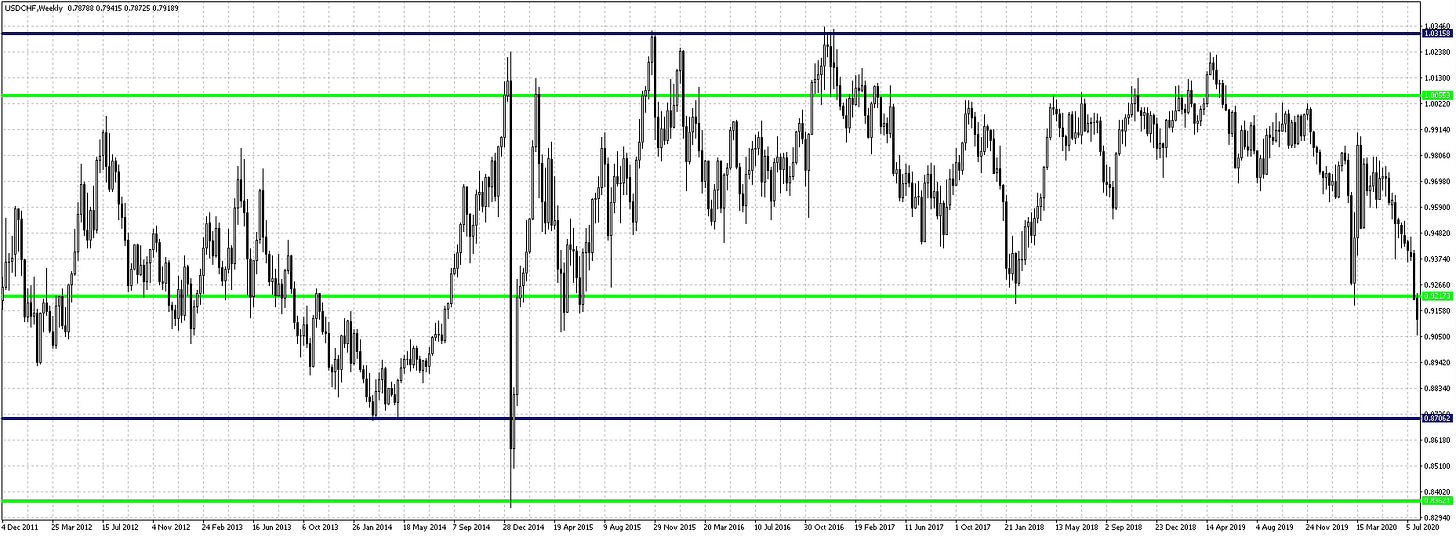

This happened to many traders back in 2015, when the Swiss unpegged from the euro*. Traders were wiped out. Brokers went bust. And the brokers that went under took with them the profits of many a trader who thought they’d made the win of a lifetime. That was a Black Swan, in all its terrible majesty and glory.

Here is another one for you, even more relevant. This weekend, in the pre-dawn Saturday hours, the US invaded Venezuela, and with surgical precision took out its dictator leader, Nicholas Maduro. He is, as I write this article, in custody in NYC, along with his wife. No one could have predicted that Trump was going to do that, much less that it would happen early Saturday. Maduro couldn’t predict it, or he wouldn’t have been there in his bed, sound asleep. I didn’t predict it. The market didn’t predict it. And the market was closed at the time, and still is.

There is no telling how the market will react today, January 4th of 2026 at 5pm US ET, when it opens. The dollar might soar. The dollar might crash. The dollar might do diddly squat. There’s really no way to know in advance. And if you have dollar trades open, you are at the whim of the market until things stabilize. I have dollar trades open. About a million dollars’ worth. I think I am reasonably hedged, so I should be okay. But I don’t know. I can’t know. Stop losses and limits won’t help, the market can blow right past them, if volatility is extreme, or if systems crash due to overload.

I use very solid brokers, like Charles Schwab, so I am 99.999% sure that I don’t have broker risk, but even that isn’t absolutely certain. Heck, you might even have no dollar exposure right now, but if your broker goes bust, your deposited funds might go with it. You can’t know. I am not trying to scare you, I am just pointing out that Black Swans cannot be avoided, sidestepped, or fully mitigated. They don’t happen all that often, but they will happen. And you have to be okay with that.

Of course, you can protect yourself to a certain point. I teach this in my course, under risk control. Here are a few ways.

- Use only very solid brokers, preferably licensed to operate in your region.

- Use multiple brokers. They’re not all going to go under. Spread your funds among them.

- Hedge. I am not going to go into detail on this one, it’s worthy of an article all by itself. If you don’t know what hedging means, you probably shouldn’t be trading yet.

- Obviously have stop losses and such, but be aware that these can sometimes not trigger for multiple reasons. Slippage, system crashes. Bad luck. And more.

- Don’t be all in on a single currency or market. Ever.

- Don’t trade the same instruments in all your accounts. For example, I have accounts where I only trade the Yen pairs. Others, only the Euro pairs. And so on.

Those are the main ones. Read my Rules’ book, there is more detail there. Ultimately, though, you will still have exposure, and you have to make your peace with that.

This has been this year’s first Public Service Announcement. I will be eagerly watching the market open tomorrow, to see what happens.

* The term “Swiss unpegging” refers to the Swiss National Bank’s (SNB) unexpected decision on January 15, 2015, to abandon the minimum exchange rate of 1.20 Swiss francs (CHF) per euro (EUR). This event, dubbed “Francogeddon,” caused massive volatility in global currency markets.

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Andy Pedraza

Latest posts by Andy Pedraza (see all)

- Black Swans - January 4, 2026

- Why Size Matters - December 21, 2025

- Why Trend Following is Easier and Less Risky - December 2, 2025