This week was a down week. This is perfectly normal and part of what we stress to our students and colleagues. There is no such thing as a perfect system, much less a 100% winning trader. Successful trading is a matter of properly applying equity to the markets via trades, while managing your risk at all times. Keep your losses small (manageable) based on the size of your account (yes, size matters, get over it), and maximize your profits to the best of your abilities (trade management).

Last week was a perfect example of maximizing profits, and this week is a perfect example of controlling risk during a losing period. Several things happened that caused the market to reverse, not least among them the ongoing schoolyard fight between Canada and Saudi Arabia, which affected all Canadian pairs. These were further weakened by sliding oil prices. This also highlights the unpredictability of the market, and why a trend following approach generally outperforms all other systems. We don’t predict trends. Why not? Because no one can. Any trend you see in the market is always in the past. The only thing that exists in the now is current price.

As traders, what we want to have is an edge. Over time, that edge translates into more money in our account. Leave predicting to carnival workers. It has no place in your trading career. And stop clicking on all those scammers’ Facebook posts asking you to type YES in the comments if you want to learn how to make a $1,000 per day. There ain’t no such thing as a free lunch. Trading requires education, mentoring (if you want to get there quicker), enough trading capital to ensure that your goals are achievable, and a comprehensive trading plan. All things (except the funding) that Special FX Academy can help you out with. Just ask. But back to this week…

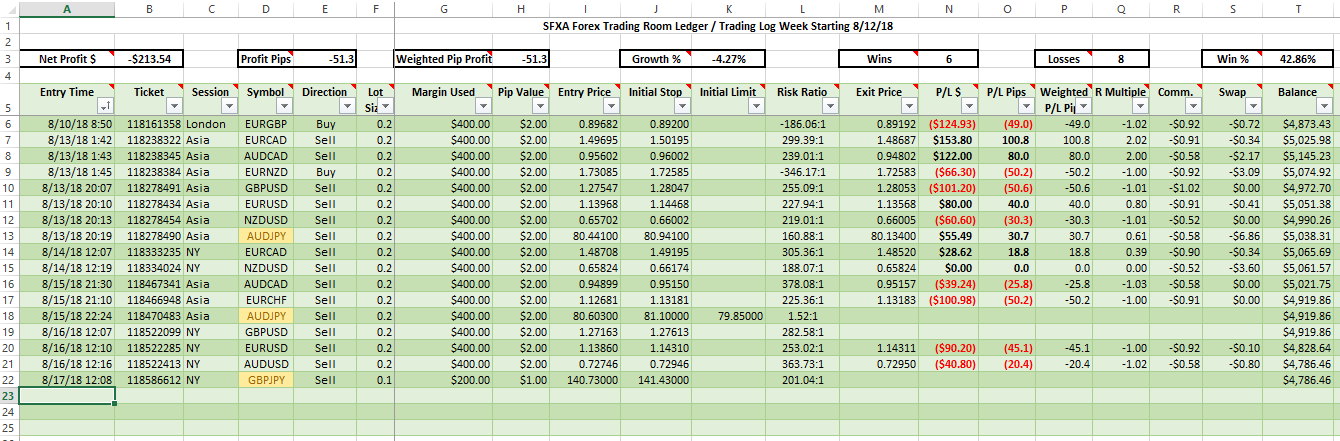

The short term account had a -4.27% drop for the week. Here are the full results:

Weekly Short Term Account Performance

- 14 trades closed, 6 wins, 8 losses

- 42.86% Win Ratio for the week

- -51.1 pips of net weighted profit for the week

- Account growth of -4.27% for the week

- 3 trade(s) held open through the weekend

Below is this week’s ledger for the Trading Room account. No hype, no hiding the losing weeks (clearly), and no tricks. Our subscribers saw us trade every single one of the trades placed live. At Special FX Academy, we are always transparent, and we hide nothing.

Another mistake we see beginners make is trying to find a “guru” trader that gives them tips. This will never work. A great trader doesn’t make it big on one isolated trade. A great trader succeeds based on all the trades they take, which in turn depends on the system they follow and their discipline in following it, and how they protect their equity against excessive losses. Taking any isolated trade as a tip is a recipe for disaster. You could be taking one of the many losing trades any trader has. Or you may luck out and take a winner, but the winner depends more on how you manage that trade while it’s open, and not on the actual trade. We’ve seen people take our exact trades and lose money while we ended profitable for the same period of time. Why? The actual trades are only a small portion of what we do as traders.

Join our sessions and trade in real time with us, and learn all of the above. This is the way trading should be, fun, safe*, and ethical (when we lose, we don’t sweep it under the rug, there is no such thing as a 100% trading system). Will we see you next week?

*All trading carries risk. Trading Forex has the potential of losses exceeding your funds. Never trade with money you cannot afford to lose. While we have a stellar record, past performance is not necessarily indicative of future performance and no guarantees are made or implied.

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Andres Pedraza

Latest posts by Andres Pedraza (see all)

- Our Trading Results for the last 12 months - April 2, 2020

- Quarterly Results – Q1/FY19 - June 30, 2019

- Key Update on Dollar Weakness and Brexit - March 20, 2019