Do you know that’s an entirely valid question but one I never thought I’d see. There are obviously no bounds to my naivety… I seriously thought as traders we were all on the same page. I just assumed that every one had a similar belief structure as me about Trading Psychology. I say similar because very few are of the exact same opinion as me, of course we wouldn’t be human if we didn’t have a difference of opinion, that’s what makes us great and interesting. I believe that Trading is 99% Psychological and 1% Position Sizing (Equity Management), that’s my belief and I find it useful.

I would suggest that my naivety stems from being a coach. As a coach everything we do to get our clients to be successful in whatever area of life that they choose, be it health, wealth, family etc. Is based solely on psychology, we are rooting out the weeds that are holding them back. Your mind is like a garden, you can grow flowers or you can grow weeds.

So not everyone agrees upon the importance of psychology in trading. We all have our own beliefs. All I can do is to give you my beliefs that serve me well as a successful trader and then ask you to consider my points and then decide for yourself if these beliefs may in fact be useful to you. Which is of course applies to all my posts.

Similar Belief

I know that very few traders share that same belief, so I take a view point that anyone one who believes that Trading is 70% Psychology or higher, has a similar belief structure to me. They understand that Trading Psychology is more important than a strategy or system. And of course I also believe that position sizing is also more important than a strategy or system.

I can say this with upmost confidence because I have seen first hand perfectly good strategies being mistraded by traders purely because their psychology wasn’t congruent with being a consistently profitable trader. Meaning you could have the best system in the world, but if your psychology is all wrong, you will still lose money.

And I can prove that position sizing is more important than a strategy by playing a simple game with dice and some imaginary players that we will call Callum, Sunigsa, Luna and Mok.

The Rules

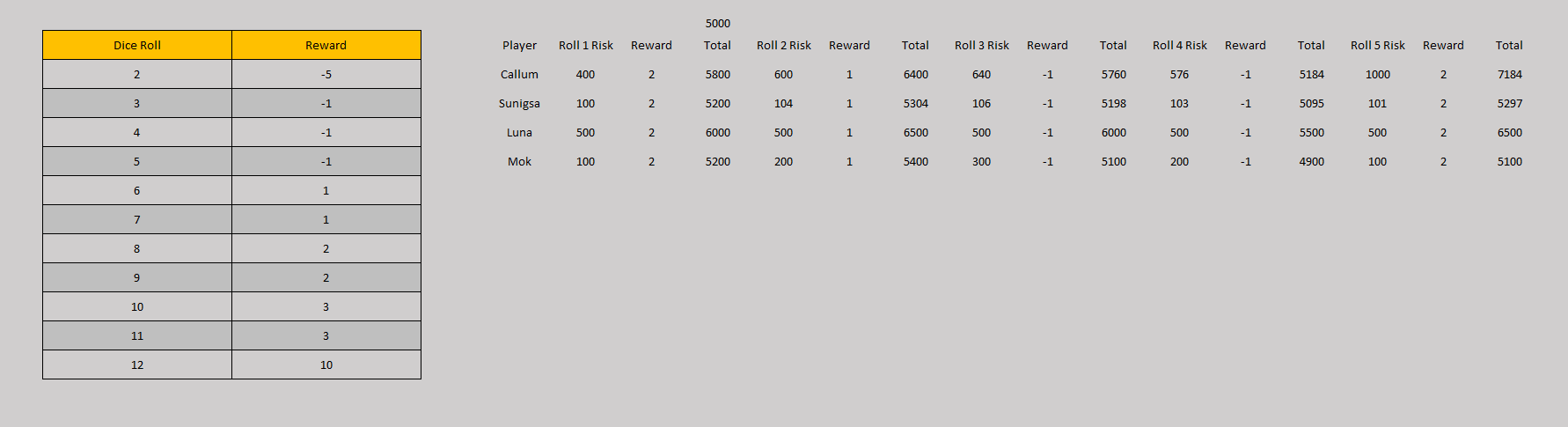

Everyone Starts with 5,000 THB the object of the game is to have the most money after the 15th dice roll. Before the dice is rolled each player will write down how much they are willing to risk from 100-5,000 baht. This is imaginary money.

There will however be a side bet, each player puts $10 into the kitty to start. It will cost $5 to buy back in with 5,000 if you go Bankrupt. Which you can do up until roll 14. At the end of a roll of the dice everyone results get recorded for all to see. At the end of roll 5 the player in fourth position puts an extra $2 into the kitty and the player in third puts $1. This is repeated after rolls 10 and 15 as well.

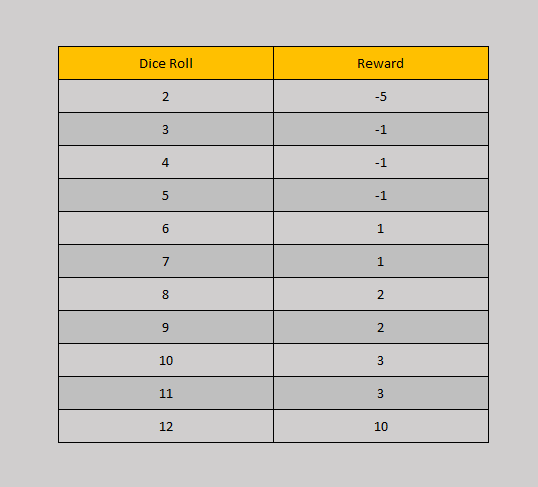

Now all we need is the rewards from rolling the dice:

So, if Callum risked 100 THB and the roll was a six, his reward would be 100 THB. If this was the first roll he would have 5,100 THB. And a good start. This is a very positive system and not very realistic, so don’t get your hopes up.

Players Personal Rules

As with all games, players will come up with their own internal rules to be added to the definitive game rules. The exact same way we do in life. Government and law give us certain rules to abide by. We as life’s players choose which ones we follow to a tee, usually the one’s that will end with jail versus the rules that just cause an inconvenience like speeding. What some might call bending the rules to suit your needs.

Back to the game, Sunigsa being Thai does not like to lose face, a very Asian trait. So under no circumstances will she allow herself to go bankrupt and has decided to risk 2% of her account per roll regardless of result or position.

Luna wants to win at all costs so she has decided to risk 500 THB for the first five rolls then re – evaluate. Mok has decided to increment her risk starting with 100 THB and then adding 100 THB after each win and reducing by 100 THB after each loss. Callum having played the game before and recognizing that the odds are stacked in the positive favor. Will start with 400 THB and then watch what the others are doing and decide the risk after each roll.

Winning The Game

First roll comes in a 9 Callum receives 800, Luna 1,000, Mok and Sunigsa 200.

Roll 2 Callum goes 600, Luna 500, Mok 200 and Sunigsa 110. This time the roll is a 7. +1 . Let’s jump to roll 5 and see how it looks.

After roll 5 Mok puts $2 into the kitty and Luna puts $1. Luna decides to up the Ante to 750. Sunigsa didn’t like coming third so will now risk 4%. And Mok decides to use 200 Increments, as she has come off the back of a win she will start with 400.

Using the Games rules to Your Advantage

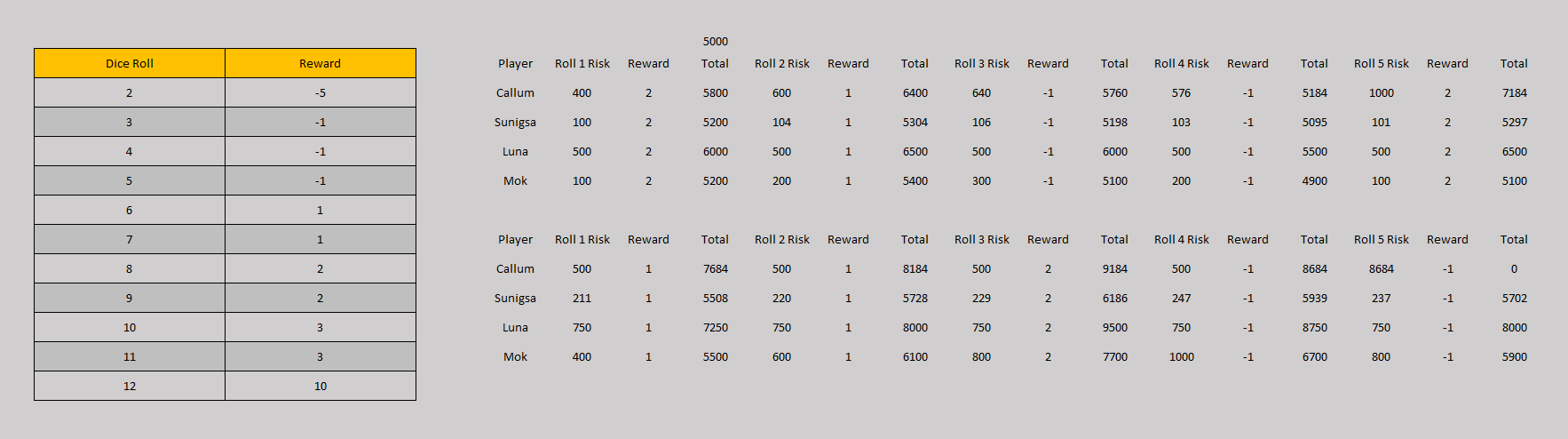

Callum having played the game before see’s the loop hole. So decides to go all in on roll 10. For those that don’t see it, for $5 he goes straight back in with 5000. He will either have a good lead going into roll 11 or he can buy himself back in. All monies going to the winner any way, so he has a 1 in 4 chance of winning it back. Lets see the next 5 rolls:

Callum pays $7, $2 for being last and $5 buy back in and will continue his all in strategy. Sunigsa pays $1 again. The kitty now stands at $51. Sunigsa decides to up the ante to 5% to try and got out of the bottom two. Luna decides to drop to 650 as she an advantage. Mok will continue as she is. Let’s have a look at the last five rolls:

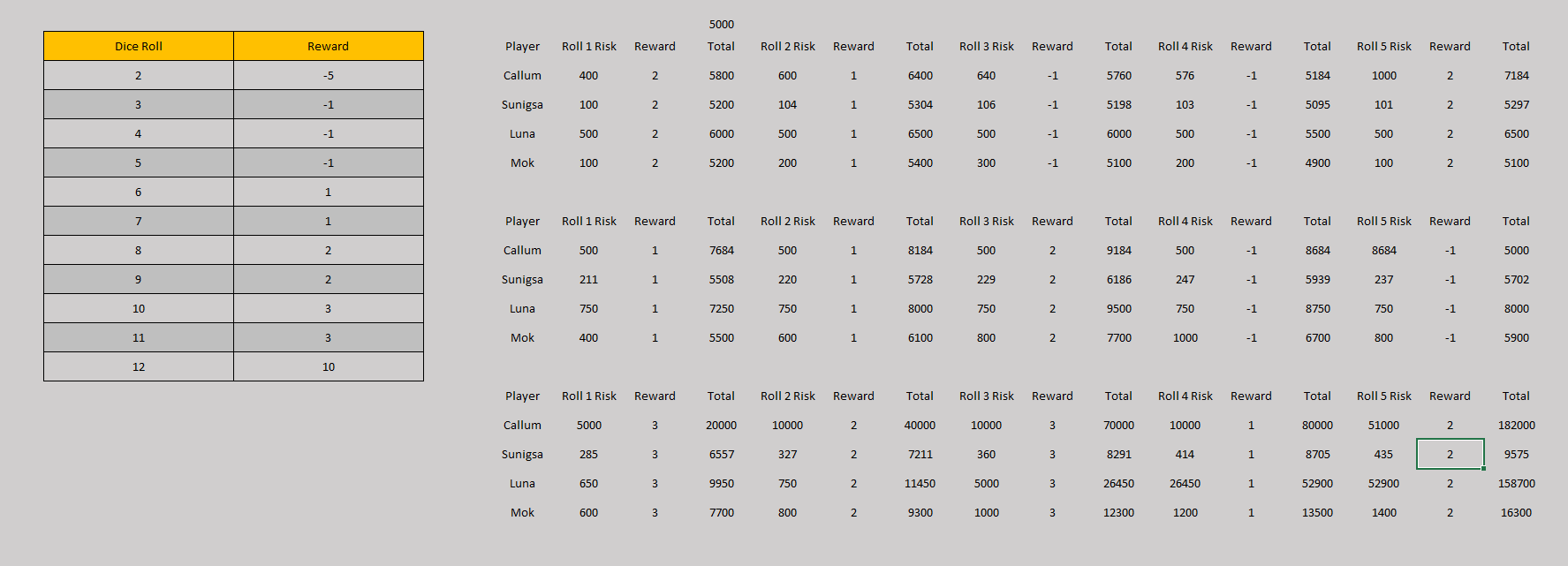

Now the point of this isn’t to say look at how well Callum did, because you would never go all in on a single trade. It does show however that a strategy doesn’t meet your objectives. It can’t be that important, we all had the same strategy with the same trade results. Yet we all walked away with differing amounts of money.

In theory we had the same broker because they was no swaps or spread. So how could it possibly end with such varing results if it is the strategy that is so important. Even if you ignore Callum’s results because he went bankrupt. The difference between Sunigsa’s and Luna’s results is a country mile. So the position size has to be more important than the strategy.

So Where Does Psychology Fit In?

Your psychology will determine your position sizing. If your objective is as most traders to grow your capital as quickly as possible, but psychologically you can only handle a 10% drawdown. Then you are at logger heads. Because your lot-size will need to be small to keep your drawdown within 10%, meaning your capital will grow slowly.

If you try to force the issue by increasing your lot-size without improving your psychology, you will make psychological mistakes. You will let your losses run, because you don’t want to take them as they may force you to a larger than 10% drawdown. If your strategy has a run of losses, you will panic fearing the loss that takes you over 10% drawdown. You will take your profits early to bank some wins to keep you away from that drawdown figure.

Does that mean you have to have the perfect psychology to earn a living at trading, “No”. I know a few traders who spend forty plus hours trading, who earn enough to pay the bills and lead a modest life. They have the same stress levels as when they were working, but at least they work from home.

Is that what you want? Is that why you spent all that time and money learning to trade? Of course not, the whole reason we all make this life decision to be traders is to reach Financial Freedom. And that’s going to take psychology. Because to be successful at anything, you must have a successful mindset. Which is the tweak most traders need in order to become successful.

We’d Like To Help

We want you to be successful. Both Andres and I agree that there is more than enough money to go around in this ole world. We will never charge you thousands for an entry system. Which is what 90% of the charlatans out there are doing. They dress it up as a strategy and all you will need to be successful…

But it just ain’t TRUE

A complete strategy is made up of so much more and too much to cover here. So I will make it the next one I post…

A successful trader trades a strategy, not an entry system. They may have bought an entry system, but I can guarantee they created a strategy around it before they made any money. It just isn’t easy to do by yourself…

So make sure you sign up for our newsletter, where we you can get all the information on our next intake of ETP students…

To Your Consistently Profitable Trading

Callum

P.S. What did you think of this Lesson? Please share it with us in the comments below!

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Callum McLean

Latest posts by Callum McLean (see all)

- Why everything you’ve been taught about risk is all wrong and how it’s keeping you poor! - November 28, 2018

- How Successful Traders Embrace Loss in Order To WIN! - November 24, 2018

- One Bias That Could Be Causing All Your Trading Frustrations… - November 14, 2018

[…] of that tedious stuff, like having an equity management system, a trading plan, or working on your psychology. After a while, of course, these “traders” stop trading, because they never achieve the […]