Every trader has a fear that they must overcome in order to trade. Unfortunately for me, it seemed like I had all of those fears. Fortunately for you guys that means that I am in a great position to help you out. Because I did what most people fail to do, I journaled my journey. And it wasn’t a straight journey by a long shot. I had to try many different methods before I found the best ones that worked, both quickly and easily.

So, I’ve done all the hard work so you don’t have to. You don’t have to go through all the trials and errors that I had to go through. All you have to do is read the post or watch the video and take the ACTION I give to you. Obviously, I’ve highlighted action for a reason. Some people seem to think they can gain success from osmosis…

Seriously, I’ve met these people. They seem to think that if they just read enough books, posts and watch enough video’s that they will get success…

If only it were that simple. You have to do the work. Nothing will change for you unless you do the work.

Fear of Loss: How Your Mind Works

So, The Fear of a Loss, what is it? Well for starters it’s not just one thing. It has several different parts that all build up to the same thing. You may suffer from all or just one of them. It doesn’t matter as the outcome is the same. You don’t follow your system, which means you’re making mistakes.

Here’s a quick recap for those of you that may have forgotten:

A mistake is to not follow your rules. If you have no rules, then everything you’re doing in the market is a mistake.

One of the ways we get caught up in the Fear of Loss is that we don’t understand how our mind works. We don’t understand how something said in passing can affect our entire lives and give us fears that are just not true. Because really, we’ve just invented them. Let me give you an example:

At a young age, you hear about someone losing their shirt either in the stock market or in forex. You may have had a family member or friend of the family lose a lot of money in stocks or forex. You may have heard your parents calling investing in stocks or forex a mug’s game, too dangerous or it’s only for fools. This sets a belief for you because at that age we are easily programmed. From here you may watch some films or read some books about people losing all their money trading. Which is then adding confirmation to your belief…

The Self-fulfilling Loop

So now you really believe that everyone loses all their money if they trade. But this is a belief that you don’t even know that you have…YET.

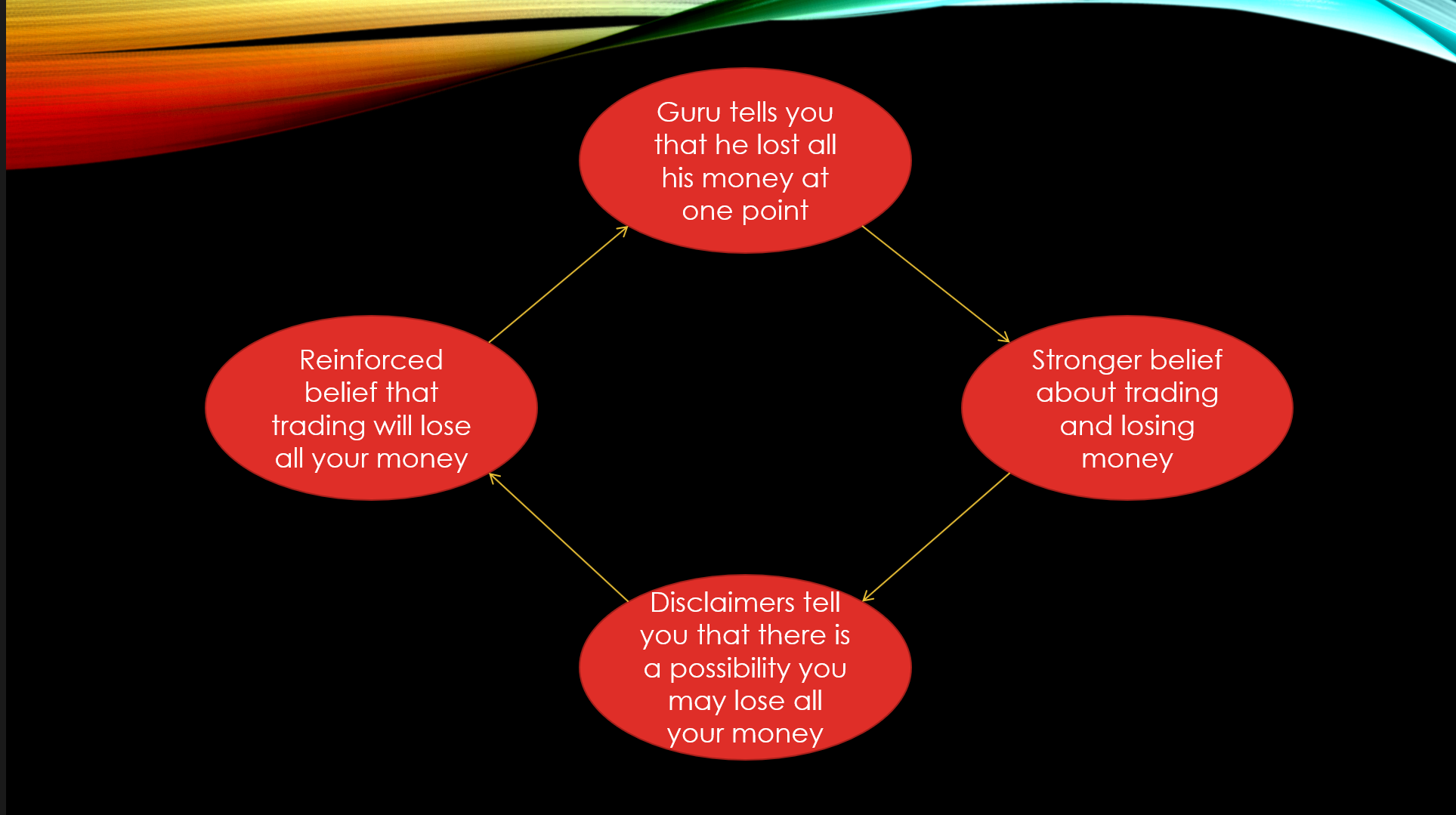

Now as an adult you decide to become a trader and go looking for advice. Well, the internet is full of people telling you how easy it is to lose all your money which reinforces your belief, so now you have an even stronger belief. You hire a guru he tells you the same. Even the disclaimers are adding weight to your hidden argument that trading is a fool’s game that will lead to the loss of all your money. A self-fulfilling loop has been created and it just keeps adding weight to its own idea.

The loop is reinforcing the loop and making your belief stronger and stronger without any effort on your part and it looks like this:

You start with the original belief “traders lose all their money”, then you go see some experts at a seminar and they tell you their story about how they lost their accounts when they first started. So now you have an even stronger belief that as a trader you will lose all your money, then you read a disclaimer that tells you that trading is inherently dangerous and you could lose all your money. Your subconscious has no idea what “could” means, it reads “if you trade you will lose all your money”. Switch out guru and disclaimer with any other events which reinforce the belief and now you have a super reinforced belief about trading and losing your money. And the loop continues.

It’s no wonder you fear a loss…

Fear and Our Minds

When it comes to fear our mind only has one output. The reptilian mind kicks in and siphons your blood away from unnecessary things… like your brain, in order to give it to your muscles. This is the fight or flight mode. When you place a trade, your brain goes into its memory banks and looks for any beliefs you have about money and trading and then applies what it knows.

Trading loses your money… Money doesn’t grow on trees, look after the pennies and the pounds (GBP) will look after themselves.

Therefore trading is BAD

Let conscious know this is extremely bad we need to stay away from this…

BOOM… fight or flight initiated. You are now ready to fight for your life or run like hell to preserve it. Your muscles are primed (tensed), your heart rate gets faster and there is less blood flowing to the brain. Basically, your mind in milliseconds has gone into your future and seen you destitute living on the streets under a bridge in Hamilton. And that’s why you get such a strong feeling and you think the world will end if you lose a trade.

The mind doesn’t know how to express danger to you in any other way, and if you keep trying to ignore it. It will do the only thing it knows to do… make the feeling stronger, make you more anxious, more uncomfortable until you close that trade…

Aaaah, feels better already. As soon as you exit that trade the feeling goes because your mind no longer feels threatened.

If you opened one in the first place.

The Fear that Prevents Action

Of course, on the other side of that, you also have the same Fear preventing you from taking the trade in the first place. The moment you start thinking about a trade, the reptilian brain has already gone to work in the form of a question.

“What if it loses?” …

There is an easy four-step process to taking a trade:

- See the signal

- Recognize that it is familiar

- Feel good about it

- Place the trade

Sounds good, doesn’t it… nice and simple. But your fear of losing changes that process to look more like this:

- See the signal

- Recognize that it is familiar

- Worry about what may happen to that trade if you enter it

- Feel bad about it

- Miss the trade

It’s only one extra step… but it changes everything.

So now we know what the fear is and how it is caused, how do we change it?

Fear of Loss: Trading Math

You must show your mind that with the correct equity management you will not lose your shirt. You have to change your beliefs about trading and losing all your money. That is the only way to interrupt a self-fulfilling loop. You have got to jump into the cycle at any point and change your belief, mean it and act upon it.

And the best way to do that is to prove it to your mind in a scientific experiment:

Hypothesis – Prove to brain a few losses won’t blow my account

Apparatus – One finger and a calculator

Method – Type into the calculator your starting trading balance. Then press minus 1% and count that as loss one. Then press minus 1% and count that as loss two. Repeat until account diminished. Then total the number of losses in a row that you would have to make in order to blow your account.

Results – You really have to do this type of experiment for yourself if you wish to get the result of losing your fear.

Discussion – Seriously don’t just stop after a few because you can understand what I am driving at. Do the task until completion and you will notice a difference. Then whenever you have that feeling of fear in the future, you can catch yourself and say “hold up, there is no tiger, I’m not in danger of dying or losing my account if this trade doesn’t make a profit. Thanks, mind I appreciate what you are trying to do, but I have done my calculations and I’ve weighed up the risk. We’re all good here.”

And picture in your mind the number of times you pressed those buttons on the way to blowing your account on a calculator. It works. Do it to completion.

If you are still struggling with your emotions and you like to know more about our Trader Accelerator Program please take a look by clicking here

This is the most comprehensive Trading Mindset course on the market without a doubt. Anything you are having a hard time with at present will be dealt with in this course as well as preventative measures going forwards. You are not alone…

To Your Trading Success

P.S if you want to watch the video instead click here

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Callum McLean

Latest posts by Callum McLean (see all)

- Why everything you’ve been taught about risk is all wrong and how it’s keeping you poor! - November 28, 2018

- How Successful Traders Embrace Loss in Order To WIN! - November 24, 2018

- One Bias That Could Be Causing All Your Trading Frustrations… - November 14, 2018