There are several schools of thought on backtesting. As usual I will give you mine.

For me its a no brainer, in terms of your psychology. Backtesting is a must, it is what makes a strategy yours. It builds confidence, you understand why your strategy works. You have a rough idea of what your strategy will achieve over the course of the year. This allows you to trade it properly, because you will know before hand what the worst drawdown may be. You understand that you may have a run of losses and this will not phase you, because you have back tested. You know that a few losses does not affect who you are, because many times as beginning traders we take losses personally. And it was a key turning point in my trading fortunes, but only when I did it correctly.

Before we get too carried away and consider that this is your answer to all your trading woes…there are pitfalls to be aware of and to watch out for. Its probably best if I start here, so that you can be aware of how your emotions will affect your back testing. Otherwise you may start back testing today and never finish…ever. I’m not exaggerating either, I spent nearly six months back testing before I realised what was going on. And I know of plenty of traders who have spent longer and many more who seem to be on a never ending cycle of backtesting. I’d like to prevent that for you, because I still believe wholeheartedly that back testing is a massive benefit to you and your trading.

What is Backtesting?

Wikipedia have it as:

In a trading strategy, investment strategy or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future.[1] Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data.

Backtesting has historically only been performed by large institutions and professional money managers due to the expense of obtaining and using detailed datasets. However, backtesting is increasingly used on a wider basis, and independent web-based backtesting platforms have emerged. Although the technique is widely used, it is prone to weaknesses.

I think they have managed to sum it up quite nicely. Of course things have changed and the data is not as expensive as it may have been. One must always remember when backtesting that your results will only be as good as the data you use. If you are a retail trader working from home you do not need to spend fortunes on data the data you have is sufficient for the purpose at hand.

Pitfalls

As mentioned above by wikipedia overfitting or better known as curve fitting. This is when you backtest your strategy over a relatively short period of time and over-optimise it. This of course makes your strategy look great on paper but in reality is very unlikely to give you those results. Let me illustrate this for you.

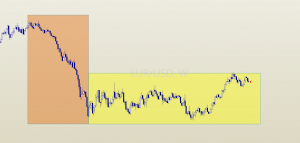

If we look at the chart above showing the weekly chart of EURUSD. And lets say for example we tested our strategy during the orange section. Then we tweaked it and perfected it so that we got the best results possible for that period. What we would have is a very curve fitted Trend trading strategy. It works perfectly for the period that we tested it. So we deploy it during the yellow section. How do you think you would fair in those conditions with a curve fitted trend trading strategy. Not very well I can tell you from experience. This is what curve fitting is, you find the best looking section of chart and design a strategy that eeks every last pip out of it. The problem you have of course is you never know when a trend like that will start.

The Mindset

We never start out with that intention when we do our backtesting, so what happens? Even when we are told to be aware of curve fitting and we are told to avoid it at all costs. It will happen to the best of you unless you know what to be aware of. Your emotions, its very easy to get lost in the backtest and get a little excited when you think you have struck gold. You may even have been curve fitting without realising it, tweaking the strategy as you go. The excitement and good feelings you get seem to make your discrepancies disappear from your mind. Sometimes you never realise what happened, you trade the strategy live and lose a small fortune. You may still have been asking yourself why…until now. Now you know you were hijacked by your positive emotions.

The subconscious is brilliant but can be easily deceived. It wants you to be happy and have good feelings, so it doesn’t reprimand you when you say to yourself “It’s only a very slight difference to my original rules. No need to go back and retest them all.”. You have been warned.

You will also be affected by your negative emotions these will have a slightly different outcome depending on the emotion and the situation. Lets say you have a fear of loss, most of us do, in fact I would suggest that 99% of all traders start out with this fear. Its hereditary it is passed on to us by our parents, our teachers, our friends and peers. Its the whole basis of schooling as we know it. The need to be right. Its the same thing, we spend most of our childhood and early adulthood being told must get 75% or more to be significant in this world. This is not a traders mindset.

The Fear of Loss

May not be the exact words or sentiment but you can understand where I am coming from and what I mean. This may even be the number one cause of traders never finding success, their fear of loss, the need to be right. Some of the most successful strategies are only right less than 30% of the time and a few of the least successful strategies are right 90% of the time or even higher. Those of you in a certain copier with a certain company will understand this more than most as you may be feeling this right now. You may be thinking how can you be right 90% of the time and still not make money. Seems impossible right.

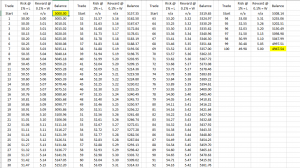

It all depends on the equity management. Let’s say for example you risk 1% to gain 0.1% and you are right 90% of the time. Every ten trades you make 0.9% and lose 1% so your net gain is -0.1%. Now lets say it doesn’t show itself at first and you win the first 90 trades. You are now up 9% in two months fantastic and now the other half of the equation comes true. You lose the next ten trades at 1%. Now you’re three months into a strategy and your 1% down. And now you feel angry, frustrated. You have spent all that time planning your retirement only to be back at the start. For those that need a visual of how it would look in your account.

Bad Advice

This is it, some of you may be thinking wish I would only lose $53 in three months and we can laugh about it now. But this is what a lot of you are doing. I quite often here beginner traders trying to give advice to beginning traders, which in of itself is not a completely bad thing. Sometimes you may be the only one at hand to give advice or maybe you just want to be helpful. It all depends on the question. The most common bit of advice I hear is to “just take the profit. Any profit is better than none”. And some of you may still be thinking that sounds like a good idea, if you are, look above. That’s the game you are playing.

There are two types of questions you will be asked. A Trading Psychology question, which if you know the answer, just go ahead and answer. Or a trading question. Any trading question should be answered just like this “What do your rules say.” Thats it. Advice given, question answered. You can not give advice to a fellow trader unless you know their rules. I know you mean well and that is a good thing. But that answer will help them so much better than any other answer you think they need to hear. Just saying.

Prevention

Admittedly that wasn’t about curve fitting, but it is worth mentioning. To prevent curve fitting you must be strict with your rules and with yourself, which will take time and effort. Much of your learning how to trade will, so get used to it. You have awareness now which is always the first step.

Pick the strategy that you want to backtest and write out your rules and create a checklist. This is your trading plan if this becomes your strategy. Go back three years on your charts max. There are plenty out there who go back decades, pointless. Things change a lot quicker now and three years is plenty. Vow to complete the backtest with no deviation you will stick to your checklist, your rules 100%. Check one candle at a time, on MT4 press F12. When you see a signal, check the time, is it within your trading hours? Which obviously you have already stated in your rules. If it is take the trade. Now you look for your exit signal, again check the time if your rules require a manual exit. You can not stay awake for 5.5 days solid. No matter how much coffee you drink.

Now if you get six months in and your strategy has not made a profit. You may stop backtesting. Change one thing/rule and start again, from the beginning and keep going until you get to present. You must do the three years with the exact same strategy, no tweaking, none. Seriously don’t do it, be strict. You can’t afford to make mistakes here, because there are still things you can’t take into account when backtesting like this. Like over-trading you may not be able to take all of these back test trades as you may be in others. So, know there are variables you can’t test for and make sure you don’t add others.

Whats next?

If you backtest this way it will prevent the curve fitting because you have decided the strategy first and not designed it to the conditions that you see in front of you. Check yourself every so often make sure you are not overly excited or fearful. The only thing on your mind should be the signal that you are looking for next. Either entry or exit signals, not Rolls Royces and jets. If your mind starts to go to the latter, take a break. Yawn and have a little stretch and then carry on.

If after completing the backtesting you think you have a strategy you want to trade. You are now ready for forward testing. See you on the next blog.

If you are struggling to learn to trade consistently by yourself, then I would suggest taking a look at our Trading Room. Here you will gain access to two coaches, Andres – Director of Trading and myself Director of Trading Psychology. Where else can you learn and be coached by a Trading coach and a Trading Psychology Coach, while making pips?

To Your Consistently Profitable Trading

Callum

P.S. What did you think of this Lesson? Please share it with us in the comments below!

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Callum McLean

Latest posts by Callum McLean (see all)

- Why everything you’ve been taught about risk is all wrong and how it’s keeping you poor! - November 28, 2018

- How Successful Traders Embrace Loss in Order To WIN! - November 24, 2018

- One Bias That Could Be Causing All Your Trading Frustrations… - November 14, 2018

[…] of routines in our trading and life was the topic for step 9. From here we moved onto step 10 and backtesting, where your strategy starts to come to […]