There are definitely some trading mistakes that are more prolific than others. But this one just keeps rearing it’s ugly head. It is by far the most common trading mistake in all the forum’s and groups that I am a member of. Bar of course the number one all time favorite mistake of at least 80% of retail traders, which of course no one really admits to, is to not have a properly written out trading plan…

#2 Most Common Trading Mistake

Is… drum role please… incorrectly trading the minors, the crosses!

What? No rapturous applause… Now you may be wondering what this has to do with psychology. Or you may not if you know my beliefs. My belief is that trading is 99% psychological and trading equity/position sizing is 1%

Because everything comes down to your belief system, but I’ll get back to that in another blog.

Psychologically people ignore some information so that their view of the world stays real to them. For example, if you believe that you are a repressed immigrant you probably are. Because you stopped trying not to be, you hang around with people that share you views and you will believe that this is the reason you are not successful.

But that view disregards all of the immigrants that are repressed, who do become successful. Because their belief is “stuff this I want better”. So they work harder and do more, the perfect ingredients for success…

Back to the Minors

So, the trading mistake is this. Traders tend to get confused as to what they are trading, and what I mean by this is quite simply. You forget the fundamentals of which currency is strong, which currency is neutral and which currency is weak.

Which looks a bit like this, they see a technical signal, like a trend line break, oversold or overbought indicator, moving average cross over, or a bounce at support or resistance. So, they take the signal with excitement as it looks like a perfect entry. This is their belief, that when their signal is triggered. The market should behave in a certain way.

Then nothing happens for days, or you get stopped out.

Which leads to those traders complaining that the currency pair hasn’t behaved as it should…

“Why didn’t GBPAUD do what it was supposed to!!!”

And yet when I go and have a look, it looks like it has. And here lies the Trading Mistake.

It all depends on your market beliefs and your perception…

Perception

Sometimes we look too closely, and we forget to look at the big picture. We can’t see the forest for the tree’s. You get so consumed with looking at the one hour chart. And then when you see the perfect entry signal for your system, you forget to look at the big picture. You don’t know if you are trading two strong currencies against each other.

For example, if GBPAUD gives the perfect buy signal but both currencies are trending higher against the dollar. There is a very good chance nothing will happen on this chart as both currencies are strong.

If however, GBPAUD gives the perfect buy signal and the GBP is trending higher against the dollar, and the AUD is flat against the dollar. Then we need to ask ourselves some questions…

Is USD not as strong as GBP but stronger than AUD, in which case the AUD could still be strong. If it’s trending higher against all the other currencies, in my book that would make it still a strong currency, just still not as strong as USD or GBP. But strong enough to keep the GBPAUD chart flat.

Confused Yet?

I keep telling you trading is complex, hopefully now you believe me!

So, how do I approach this?

My system is this. If I am planing on day trading I look at the movement of the majors. Which obviously is a lot less time consuming than looking at all of the pairs. From here I am looking at strength versus weakness, without all the fancy indicators.

If all the currencies are up against the dollar, then obviously I am looking for signals against the dollar. I don’t even bother to look at the crosses, as it will probably be one of those days when the crosses don’t move. So I don’t see the point in wasting my energy.

If however the GBP is up against the USD and the AUD is down against the dollar. Then the chart to go look at first for a buy signal is GBPAUD. Pound strength against Aussie weakness. If that play was reversed and the AUD was up against USD and GBP was down against USD then I would go to the same chart but look for a sell.

The Majors

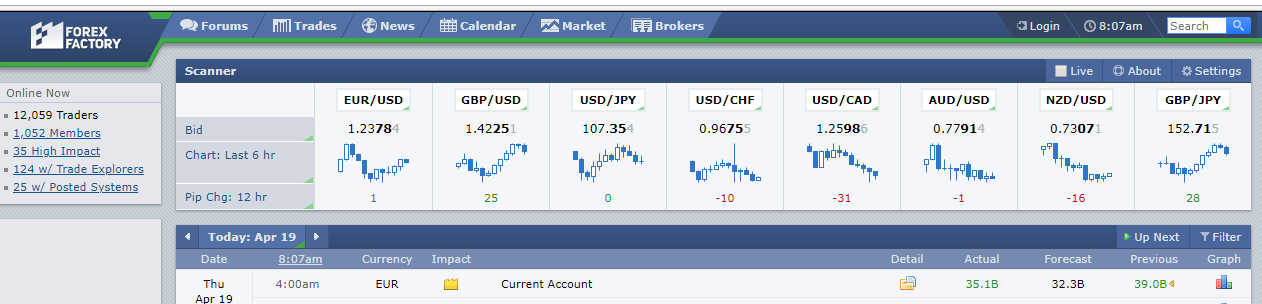

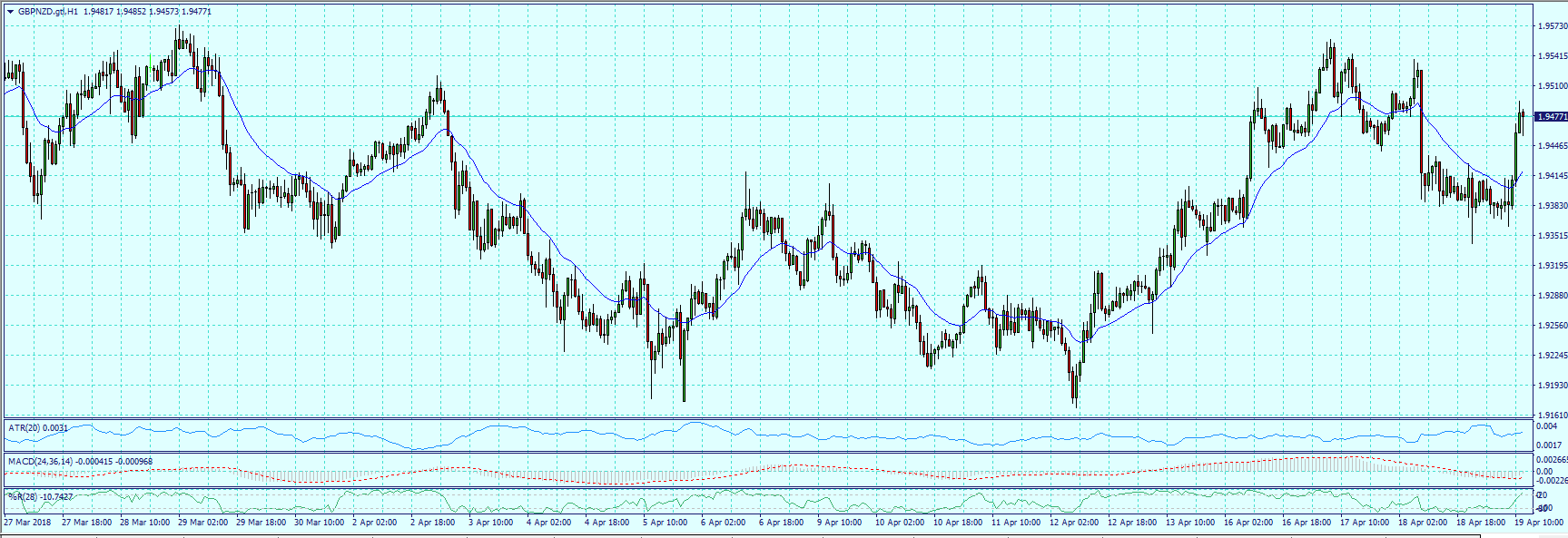

The Trading Mistake really is an obvious one, that took me a very long time to grasp. Don’t make my mistakes. Learn this trick and add it to your trading system. Let me show you an example of what I am seeing right now as I write this Thursday 19th April 2018 at 8:20 am.

So this is a screenshot of Forex Factory calendar. And at the top we have their scanner. A quick look shows us that the GBP is up by 25 pips over the last six hours against the USD. EUR and AUD are +1 and -1 respectively. However, the NZD is down against the GBP. So a quick look here as told me to go and look at the GBPNZD for a possible setup.

This is the chart that is moving, that is the benefit of understanding how to use the majors to spot strength and weakness. You may find it useful to get you into trades or you may find it helpful to keep you out of some trades.

As with everything you are ever shown, test it out for yourself before using it in your trading. But used correctly it can greatly improve your trading results. Hopefully this knowledge will keep you out of some of those trading mistakes.

To Your Consistently Profitable Trading

Callum

P.S. What did you think of this Lesson? Please share it with us in the comments below!

Buy a subscription to any of our Trading Services, the FX CopyTrader, the FX Trading Room, or our FX Signals, and get the other two for free! No coupons needed. You'll be subscribed to all 3 automatically no matter which one you purchase!

Callum McLean

Latest posts by Callum McLean (see all)

- Why everything you’ve been taught about risk is all wrong and how it’s keeping you poor! - November 28, 2018

- How Successful Traders Embrace Loss in Order To WIN! - November 24, 2018

- One Bias That Could Be Causing All Your Trading Frustrations… - November 14, 2018